5 Major Financial Rule Changes Effective Today, Jan 1: As India rings in 2026, several significant regulatory shifts kick in that will directly impact household budgets, banking habits, and government employees. Here is your complete guide to what changes starting today. 8th Pay Commission, 8th Pay Commission 2026, New Rules from 1st January 2026, LPG Price Today, Commercial Gas Cylinder Rate, ICICI Credit Card Charges, Credit Score New Rules 2026, CIBIL Score Update, Bank Holidays January 2026, Govt Employees News, DA Hike January 2026, Ikkis Movie Release, Financial Rules Change India, Twspost News Times

By Twspost News Desk | Published: January 1, 2026

Welcome to 2026! While the confetti is still settling and New Year’s resolutions are being made, the financial landscape in India has already shifted overnight. As is customary on the first day of the year, several new government regulations, banking norms, and price revisions have come into effect today, January 1, 2026.

From the highly anticipated timeline of the 8th Pay Commission for central government employees to stricter rules regarding your credit score and new charges on credit cards, these changes will affect nearly every citizen’s wallet in one way or another.

At Twspost News Times, we have compiled a detailed breakdown of the five most crucial developments you need to know to navigate your finances in this new year.

1. The 8th Pay Commission Timeline Begins: What It Means

The most significant talking point going into 2026 is undoubtedly the 8th Pay Commission. While many government employees might be waking up hoping for an immediate salary jump, it is crucial to understand the technicalities of today’s date.

The “Effective Date” vs. “Implementation Date” Technically, the recommendations of a new Pay Commission are usually made effective from January 1st of the year it is constituted or scheduled. Therefore, January 1, 2026, marks the start of the period for which the 8th Pay Commission’s recommendations will eventually apply.

However, this does not mean salaries have increased today. The Commission will now begin the arduous process of analyzing current economic conditions, inflation data, and salary structures to formulate their recommendations.

Expectations vs. Reality:

The Wait: The entire process, from constitution to report submission and final government approval, typically takes 18 months to two years.

The Arrears: The good news is that once the hike is finally implemented (likely in 2027 or 2028), employees will receive arrears calculated from today’s date, January 1, 2026.

Projected Hike: Experts speculate a salary revision in the range of 20% to 35% to combat inflation accumulated over the last decade.

For today, the news is that the clock has officially started ticking on the next major salary revision for over a crore central government employees and pensioners.

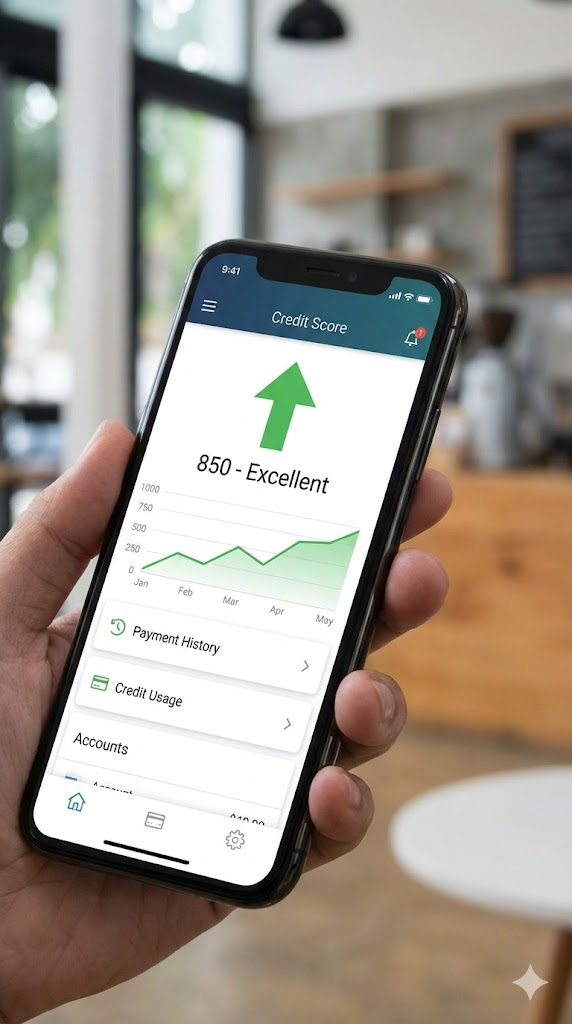

2. Your Credit Score Will Now Change Weekly

This is perhaps the most impactful change for the average consumer’s personal finance. Until yesterday, Credit Information Companies (CICs) like CIBIL, Experian, and Equifax updated consumer credit scores on a monthly basis.

Starting today, January 1, 2026, per new Reserve Bank of India (RBI) guidelines aimed at increasing transparency, banks and lenders must report credit information to CICs on a fortnightly or weekly basis.

The Impact on You: This faster reporting cycle means your credit score has become much more dynamic.

The Good: If you make a large credit card payment or clear a loan, your score will improve much faster, allowing you to access new credit sooner.

The Bad: Conversely, if you miss an EMI or a credit card due date, it will reflect on your score almost immediately. The grace period where you could “fix” a missed payment before the month-end report is effectively gone. Financial discipline is now more critical than ever.

3. New Credit Card Charges (Focus: ICICI Bank)

Major banks often revise their fee structures effective from the New Year. Leading the change this year is ICICI Bank, which has introduced new charges that cardholders must be aware of starting today.

If you are an ICICI Bank credit card user, note these two major shifts:

Utility and Insurance Spend Capped: Spending on utility bills (electricity, gas, water) and insurance premiums is now capped for rewards. While the exact cap varies by card type, significant spends in these categories may now attract a handling fee if they exceed a certain threshold (e.g., ₹50,000 per month).

Gaming Transactions Taxed: In an effort to curb excessive spending on online betting and gaming platforms, a direct 2% transaction fee will now be levied on all online gaming transactions made using ICICI credit cards.

Other banks are expected to follow suit with similar curbing measures in the coming weeks.

4. LPG Cylinder and Fuel Price Revision

As is the standard practice on the first day of every month, Oil Marketing Companies (OMCs) have revised the prices of Liquefied Petroleum Gas (LPG) cylinders and Aviation Turbine Fuel (ATF).

While domestic LPG cylinder prices have remained relatively stable due to government subsidies ahead of upcoming electoral cycles, the prices of commercial LPG cylinders (used in restaurants and hotels) have seen a revision today. Depending on international crude oil prices and currency fluctuations, commercial cylinders in metro cities may see a price hike of ₹25 to ₹50 starting today.

Consumers are advised to check their respective gas booking apps for the latest rates in their city.

5. The Deadline Has Passed: PAN-Aadhaar and SIM Card Rules

If you are reading this on January 1st and still haven’t linked your PAN with your Aadhaar, you are now facing immediate consequences.

PAN Becomes Inoperative: The absolute final deadline was December 31, 2025. Starting today, unlinked PAN cards are deemed “inoperative.” This means you cannot file income tax returns, pending refunds will not be processed, and higher TDS will be deducted on your income. Reactivating it will now require payment of a heavier penalty.

Stricter SIM Verification: Also effective today are new Department of Telecommunications (DoT) rules regarding SIM card sales. The process for getting a new SIM has become stricter, requiring mandatory digital biometric verification at the point of sale to curb cyber fraud. Additionally, bulk buying of SIM cards by individuals is now heavily restricted and monitored.

On a Lighter Note: Entertainment

It’s not all heavy financial news. January 1st is also a big day for Bollywood. To kickstart the year’s entertainment, the war drama ‘Ikkis’, starring Agastya Nanda, and the patriotic film ‘Azad Bharath’ are scheduled for release in theaters nationwide today.

Conclusion

As we step into 2026, these changes remind us that agility in financial planning is essential. The new credit score rules require diligence, and the start of the 8th Pay Commission cycle offers medium-term hope for government staff. Stay tuned to Twspost News Times as we track the implementation and impact of these new rules throughout the month.

Frequently Asked Questions (FAQs) on New Rules 2026

Q: Has my salary increased today because of the 8th Pay Commission? A: No. January 1, 2026, is the start date for calculating potential future arrears. The actual salary hike will only happen after the Commission submits its report and the government accepts it, which will take time.

Q: Are banks open today, January 1st? A: It depends on your location. Banks are generally open across most of India on New Year’s Day, as it is not a national gazetted holiday. However, banks remain closed in specific states like Mizoram, Sikkim, and Tamil Nadu due to local holiday lists.

Q: My PAN is not linked to Aadhaar. Can I still use my bank account today? A: Yes, your bank account remains active for deposits and basic withdrawals. However, you will face major issues with transactions requiring PAN quotation (like deposits over ₹50,000), and your tax-related activities will be frozen.

| Home | Google News | YouTube | ||

|---|---|---|---|---|

| Link | Link | Link | Link | Link |